Open in Colab: https://colab.research.google.com/github/ryanraba/stocksml/blob/master/docs/quick_start.ipynb

Installation¶

Normal installation from the command line (assuming you have Python3 installed)

$ python3 -m venv venv

$ source venv/bin/activate

(venv) $ pip install stocksml

From a Jupyter notebook environment such as Google Colab

!pip install stocksml

Quick Start¶

Quick demonstration using included sample data sources.

[1]:

import os

os.system("pip install stocksml")

print('installed stocksml')

installed stocksml

[2]:

from stocksml import Demo

Demo(notebook=True)

2021-02-01 buy market order for 24 shares of vixm at 0.0 -> bought 24 shares at 41.6 ($0.9, $1000.0, 43.2, 41.6, 41.6, 41.9 )

2021-02-01 sell limit order for 24 shares of vixm at 40.9 -> sold 24 shares at 41.6 ($1000.0, $1000.0, 43.2, 41.6, 41.6, 41.9 )

2021-02-02 buy market order for 24 shares of vixm at 0.0 -> bought 24 shares at 41.2 ($11.4, $1000.0, 41.3, 40.6, 41.2, 40.7 )

2021-02-02 sell limit order for 24 shares of vixm at 42.6

2021-02-03 sell market order for 24 shares of vixm at 0.0 -> sold 24 shares at 40.2 ($977.4, $977.4, 40.5, 39.9, 40.2, 39.9 )

2021-02-03 buy market order for 24 shares of vixm at 0.0 -> bought 24 shares at 40.2 ($11.4, $977.4, 40.5, 39.9, 40.2, 39.9 )

2021-02-03 sell limit order for 24 shares of vixm at 43.4

2021-02-04 sell market order for 24 shares of vixm at 0.0 -> sold 24 shares at 39.5 ($959.2, $959.2, 39.8, 39.2, 39.5, 39.7 )

2021-02-04 buy market order for 24 shares of vixm at 0.0 -> bought 24 shares at 39.5 ($11.4, $959.2, 39.8, 39.2, 39.5, 39.7 )

2021-02-04 sell limit order for 24 shares of vixm at 40.4

2021-02-05 sell market order for 24 shares of vixm at 0.0 -> sold 24 shares at 39.4 ($958.0, $958.0, 40.0, 39.4, 39.4, 39.9 )

2021-02-05 buy market order for 24 shares of vixm at 0.0 -> bought 24 shares at 39.4 ($11.4, $958.0, 40.0, 39.4, 39.4, 39.9 )

2021-02-05 sell limit order for 24 shares of vixm at 40.6

---------- liquidate ----------

2021-02-05 sell market order for 24 shares of vixm at 0.0 -> sold 24 shares at 39.9 ($968.1, $968.1, 40.0, 39.4, 39.4, 39.9 )

---------- result = $968.1 at 0.932 of baseline ----------

Load Data¶

[3]:

from stocksml import LoadData, BuildData

# load symbols and build a symbol dataframe

sdf, symbols = LoadData(symbols=['SPY','BND'])

# convert symbol dataframe to a feature dataframe

fdf = BuildData(sdf)

fdf.head()

building BND data...

building SPY data...

[3]:

| bnd0 | bnd1 | bnd2 | bnd3 | bnd4 | spy0 | spy1 | spy2 | spy3 | spy4 | |

|---|---|---|---|---|---|---|---|---|---|---|

| date | ||||||||||

| 2017-01-03 | -0.001654 | -0.000511 | -0.001190 | -0.000778 | 0.371118 | -0.004692 | -0.003802 | -0.003938 | -0.003082 | 0.018743 |

| 2017-01-04 | 0.009508 | 0.018398 | 0.053818 | 0.006910 | 0.080335 | 0.028361 | 0.045359 | 0.013076 | 0.026660 | 0.391944 |

| 2017-01-05 | 0.109609 | 0.010800 | 0.025270 | 0.051719 | 0.385050 | -0.010775 | -0.007476 | 0.015081 | -0.007054 | 0.026528 |

| 2017-01-06 | -0.043183 | 0.003252 | 0.021451 | -0.041545 | -0.413196 | 0.037203 | 0.008074 | 0.003648 | 0.014804 | 0.152411 |

| 2017-01-09 | 0.012214 | 0.010019 | 0.011997 | 0.024802 | -0.107640 | -0.028913 | 0.010770 | 0.007136 | -0.019585 | -0.380552 |

Build a Model¶

Define a model and create a set of 2 or more with corresponding training data.

[4]:

from stocksml import BuildModel

models, dx = BuildModel(fdf, len(symbols), layers=[('rnn',32),('dnn',64),('dnn',32)], count=2)

models[0].summary()

Model: "model"

__________________________________________________________________________________________________

Layer (type) Output Shape Param # Connected to

==================================================================================================

input (InputLayer) [(None, 5, 10)] 0

__________________________________________________________________________________________________

rnn_0 (SimpleRNN) (None, 32) 1376 input[0][0]

__________________________________________________________________________________________________

dnn_1 (Dense) (None, 64) 2112 rnn_0[0][0]

__________________________________________________________________________________________________

dnn_2 (Dense) (None, 32) 2080 dnn_1[0][0]

__________________________________________________________________________________________________

action (Dense) (None, 5) 165 dnn_2[0][0]

__________________________________________________________________________________________________

symbol (Dense) (None, 2) 66 dnn_2[0][0]

__________________________________________________________________________________________________

limit (Dense) (None, 1) 33 dnn_2[0][0]

==================================================================================================

Total params: 5,832

Trainable params: 5,832

Non-trainable params: 0

__________________________________________________________________________________________________

Learn a Strategy¶

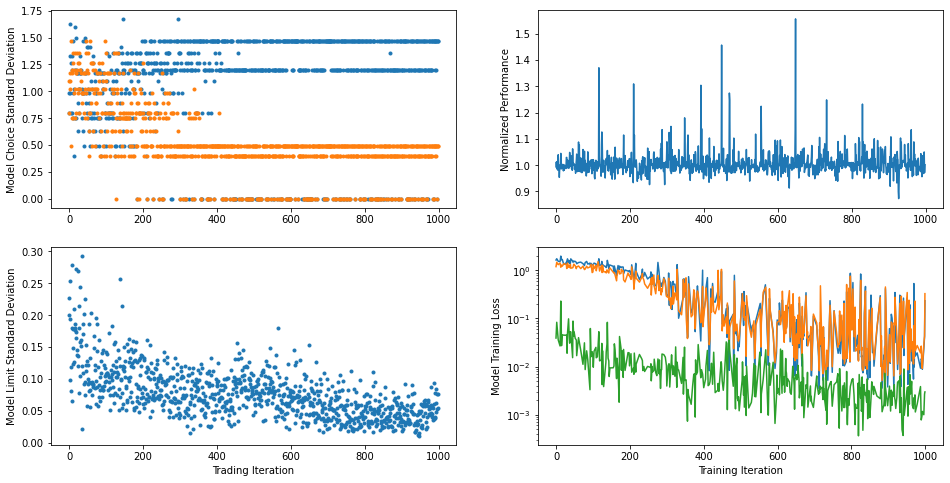

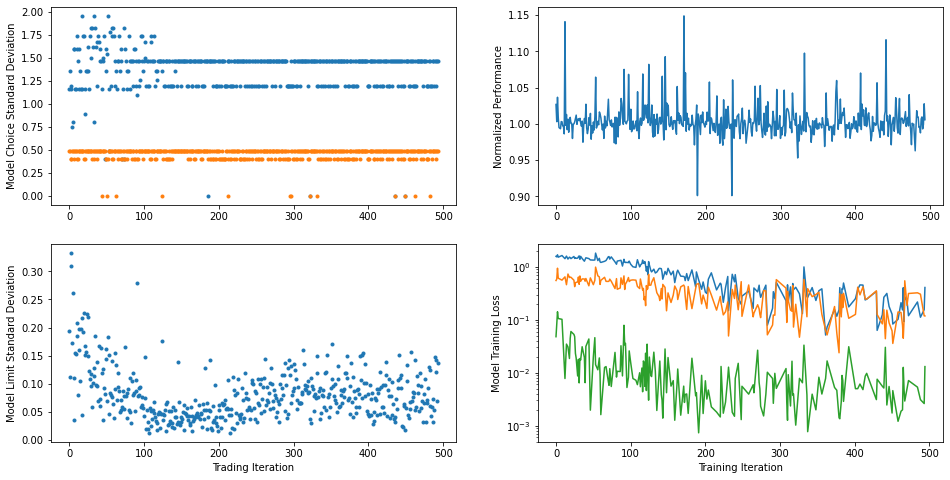

After creating a set of adversarial models and the corresponding training data formatted for them, StocksML is ready to learn a new trading strategy. This is done in an unsupervised manner, meaning no truth data is provided.

The algorithm begins with each model making random guesses. When one model successfully guesses a sequence of trades that results in superior performance (i.e. makes money or beats a benchmark), that model’s strategy is “learned” by the unsuccessful model. This continues for a set period of iterations or until it appears that the models are no longer learning anything useful.

The LearnStrategy function displays a live plot of various metrics to illustrate the learning process and help inform when a good stopping point might be.

[5]:

from stocksml import LearnStrategy

LearnStrategy(models, sdf, dx, symbols, 'SPY', 5, 500, True)

Examine the Strategy¶

Once a trading strategy has been learned, it can be applied to different points in time across the available market data to see what it does and how it performs.

To avoid overfitting, it would be wise to examine strategy performance on data that wasn’t used for training.

[6]:

from stocksml import ExamineStrategy

ExamineStrategy(models[0], sdf, dx, symbols, '2021-02-01', days=5, baseline='SPY')

2021-02-01 buy market order for 2 shares of spy at 0.0 -> bought 2 shares at 376.2 ($247.5, $1000.0, 377.3, 370.4, 373.7, 376.2 )

2021-02-02 sell limit order for 2 shares of spy at 397.7

2021-02-03 sell market order for 2 shares of spy at 0.0 -> sold 2 shares at 382.4 ($1012.4, $1012.4, 383.7, 380.5, 382.4, 381.9 )

2021-02-03 buy market order for 2 shares of spy at 0.0 -> bought 2 shares at 382.4 ($247.5, $1012.4, 383.7, 380.5, 382.4, 381.9 )

2021-02-03 sell limit order for 2 shares of spy at 390.0

2021-02-04 sell market order for 2 shares of spy at 0.0 -> sold 2 shares at 383.0 ($1013.5, $1013.5, 386.2, 382.0, 383.0, 386.2 )

2021-02-04 buy market order for 2 shares of spy at 0.0 -> bought 2 shares at 383.0 ($247.5, $1013.5, 386.2, 382.0, 383.0, 386.2 )

2021-02-04 sell limit order for 2 shares of spy at 389.9

2021-02-05 sell limit order for 2 shares of spy at 346.2 -> sold 2 shares at 388.2 ($1023.9, $1023.9, 388.5, 386.1, 388.2, 387.7 )

2021-02-05 buy market order for 11 shares of bnd at 0.0 -> bought 11 shares at 87.0 ($67.4, $1023.9, 87.1, 87.0, 87.1, 87.0 )

---------- liquidate ----------

2021-02-05 sell market order for 11 shares of bnd at 0.0 -> sold 11 shares at 87.0 ($1023.9, $1023.9, 87.1, 87.0, 87.1, 87.0 )

---------- result = $1023.9 at 0.986 of baseline ----------